Philosophy didn’t die with the downfall of the Grecian Empire. Just because the Acropolis is in ruins doesn’t mean personal beliefs are shattered. Where does it state philosophy can only be created by old men wrapped in bed sheets?

Philosophy didn’t die with the downfall of the Grecian Empire. Just because the Acropolis is in ruins doesn’t mean personal beliefs are shattered. Where does it state philosophy can only be created by old men wrapped in bed sheets?

Each of us already has our own personal philosophy somewhere inside. How we live our lives. How we treat our customers. How we run our businesses. It’s already part of us.

But when was the last time you consciously thought about your philosophy?

Clearly articulating your personal philosophy makes you stand out from the crowd. Not many people sit down, put fingers to keyboard, and root their beliefs for the world to see.

If you have read my book, Better than Average: Excelling in a Mediocre World, seen one of my speeches, or sat with me at 30,000 feet while crossing the country, you have seen these principles in action.

If you’re a first-timer or passerby, welcome, and here is what I believe.

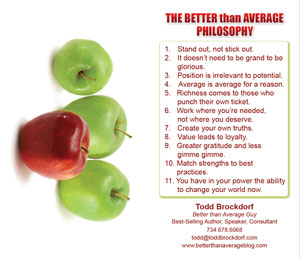

The Better than Average Philosophy

- Stand out, not stick out.

- It doesn’t need to be grand to be glorious.

- Position is irrelevant to potential.

- Average is average for a reason.

- Richness comes to those who punch their own ticket.

- Work where you’re needed, not where you deserve.

- Create your own truths.

- Value leads to loyalty.

- Greater gratitude and less gimme gimme.

- Match strengths to best practices.

- You have in your power the ability to change your world now.

How do I make a Philosophy Card?

If you want to make your own philosophy card, answer the following question.

If you could have the world any way you wanted, what would it look like, feel like and be like in every way? List out your responses. Each statement completes the sentence, “I believe…”

Your responses are your philosophy.

Print it on some glossy card stock and you are in business!

What do I do with it?

- Pass it out in addition to your business card

- Use it as a handout

- Challenge others to make their own cards

Average people have business cards. The Better than Average carry philosophy cards.

Next time someone hands you his business card, hand him your philosophy card (and a business card).

The world needs more transparency, honest conversation, and open books. Let them read you and they will respond.

Acknowledgement

The idea for the philosophy card came from a fellow author and speaker, Scott Ginsberg. You may read more about him on his site here.

QUESTION FOR YOU –

What do you stand for?

SOMETHING FOR YOU –

Worldwide visibility. If you create a philosophy card and send it to me, I will include it in a future post. I bet you won’t do it.

_____

Todd Brockdorf

Better than Average Guy

#1 Best-Selling Author, Speaker, Thought Leader

[email protected]